Stop Leaving Money on the Table: A Cross‑Sell Playbook for Health‑Insurance Brokers

How a straightforward conversation can unlock bigger commissions, deeper client loyalty, and a thriving Latino book of business.

How a straightforward conversation can unlock bigger commissions, deeper client loyalty, and a thriving Latino book of business.

The Million‑Dollar Question Agents Forget to Ask

You just finished an enrollment call: eligibility checked, plan selected, signature captured. Job well done, right?

But as soon as you hang up, the same thought creeps in:

“I could have helped that client with even more.”

If that sounds familiar, you’re in good company. Industry surveys show that 68% of health insurance agents sell only the “primary” product (Medicare Advantage, PDP, Marketplace plan) and then move on. The result?

- Smaller average revenue per client

- Shallow relationships that invite competitor poaching

- Clients who discover after a hospitalization or dental bill that their coverage still leaves gaps

In short, skipping the cross‑sell costs everyone: you lose revenue, and clients lose protection.

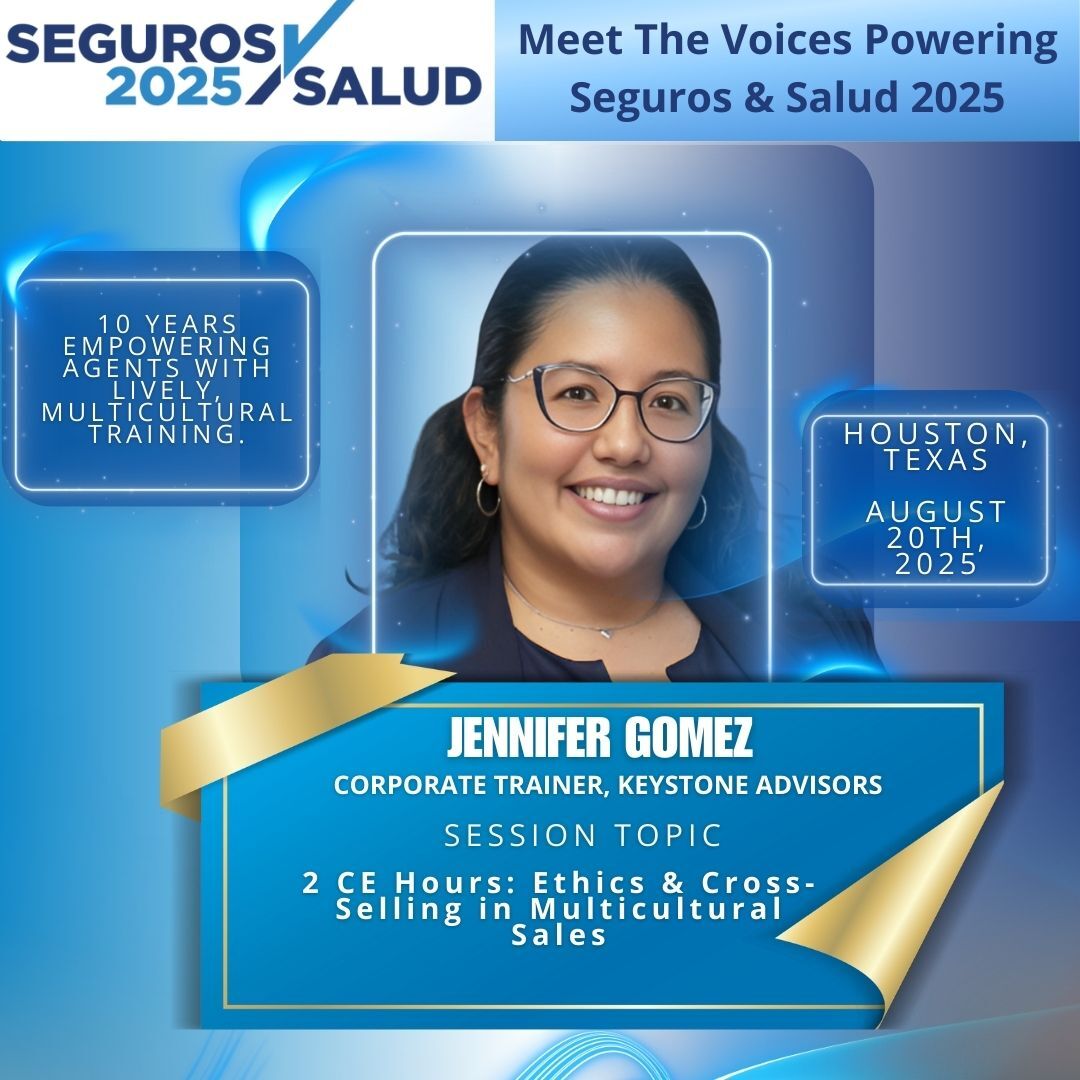

This article solves that problem. We sat down with Jennifer Gomez, compliance expert, bilingual trainer to thousands of agents, and keynote speaker at Seguros & Salud 2025—and distilled her best tactics into a playbook you can execute this week. Whether you're a seasoned broker or new to the field, these strategies will help you:

- Add high‑margin supplemental products without feeling “salesy.”

- Strengthen retention in Latino communities through culturally aware conversations

- Boost average household revenue by 20–30 % in under 90 days

Let’s dive in.

Why Agents Skip the Cross‑Sell (and How to Fix It)

“I don’t want to overwhelm the client.” Clients want guidance. Most just don’t know what to ask for. Present options as solutions to their specific worries, not as a sales menu.

“I’m short on time during AEP/OEP.” A five‑minute cross‑sell today saves a costly churn call later. Use scripted transitions that take 30 seconds to set up.

“I’m not sure which product to offer.” Hospital indemnity, DVH, and life are evergreen needs. Start with the three wins below; expand once these feel natural.

Three Instant‑Win Add‑Ons (with Ready‑to‑Use Scripts)

Crafted by Jennifer Gomez, these offers are 100 % compliant and proven in bilingual markets.

1. Hospital Indemnity After MA

Problem it solves: Medicare Advantage copays for inpatient stays can be a budget buster.

Why it sells: Clients fear surprise bills more than ongoing premiums.

Script Starter (English):

“If a hospital stay ever sneaks up on you, this puts cash in your pocket fast.”

Script Starter (Spanish):

“Si alguna vez necesita hospitalización, este plan le devuelve dinero directo, sin papeleo complicado.”

Pro Tip: Ask, “Do you have $300–$600 set aside for a hospital copay right now?” Most don’t; the indemnity plan becomes a no‑brainer.

2. Dental/Vision Before You Close PDP

Problem it solves: Original Medicare and many PDPs exclude routine dental and vision.

Why it sells: You’re already talking about prescriptions; oral and eye health feels like a natural extension.

Script Starter:

“How about we bundle cleanings and eye exams for just $ X a month? Same card, one bill.”

Pair with a zero‑premium PDP to show the net cost barely moves. Latino seniors in particular value dental care as a quality‑of‑life issue: use that cultural insight.

3. Life Coverage on the Follow‑Up Call

Problem it solves: Funeral costs average $8,000 in the U.S.; most families aren’t prepared.

Why it sells: Post‑sale trust is highest 24–48 hours after enrollment. Strike while the gratitude is fresh.

Script Starter:

“We protected your health; next let’s secure your family’s future.”

Schedule a 10‑minute virtual chat two days later. Offer final‑expense life at $25–$35/month, often less than a family’s weekly coffee run.

Making the Conversation Culturally Relevant

Jennifer emphasizes two touchpoints when working with Latino households:

- Lead with family impact.

- “Esta cobertura protege a tu mamá si necesita hospitalización—y evita que sus hijos carguen con la cuenta.”

- Mirror language preference.

- Even partially bilingual clients appreciate being spoken to in their preferred language for complex topics.

Both strategies build trust and cut rapid disenrollment (a chronic issue in multicultural books).

Workflow: 5‑Minute Cross‑Sell Routine

- Finish primary enrollment (verify doctor, Rx list).

- Transition: “Before we wrap up, can I cover two quick ways families protect their budgets?”

- Offer product #1 (hospital indemnity or DVH).

- Handle a single objection (“Let’s compare cost vs. a one‑night stay.”).

- Close or calendar a follow‑up.

- Set task in CRM for two‑day life‑policy callback.

Average extra time: 4–6 minutes. Average extra revenue: $65–$120 per household. Worth it.

Live Role‑Plays & CE Credits at Seguros & Salud 2025

Ready to see these scripts in action? Jennifer Gomez will:

- Perform bilingual role‑plays on stage, watch her pivot from MA to hospital indemnity without skipping a beat.

- Break down compliance red flags so you stay audit‑proof.

- Offer a 2‑hour Ethics + Cross‑Selling workshop, earn CE credits while practicing live.

Every tactic is tailored to multicultural, Spanish‑dominant markets. Bring your toughest objections; Jennifer will show how to flip them into yeses.

Bottom Line: Your Next Steps

- Choose one product from above and commit to offering it on every call this week.

- Use Jennifer’s script verbatim until it feels natural.

- Track results: number of pitches vs. conversions. You’ll be shocked at the lift.

- Lock your spot at Seguros & Salud 2025 to master the full arsenal, seats are disappearing fast.

Broker partners: use code BROKER for a $99 full‑day badge (includes 2 CE credits).

Morning‑only vouchers available with code VOUCHER if you’re curious but tight on time.

Ready to Stop Leaving Money on the Table?

Click below, grab your badge, and join hundreds of bilingual producers turning cross‑sells into community impact—and six‑figure renewals.

Register Now | August 20 • Houston

.png?width=6912&height=2492&name=Untitled%20design%20(1).png)